Churches to appear at Yoorrook

Congregation gives generously

Faith in the public square

Sunshine and shadows

That’s what friends are for

Reflections on Easter

Focus is on new faces

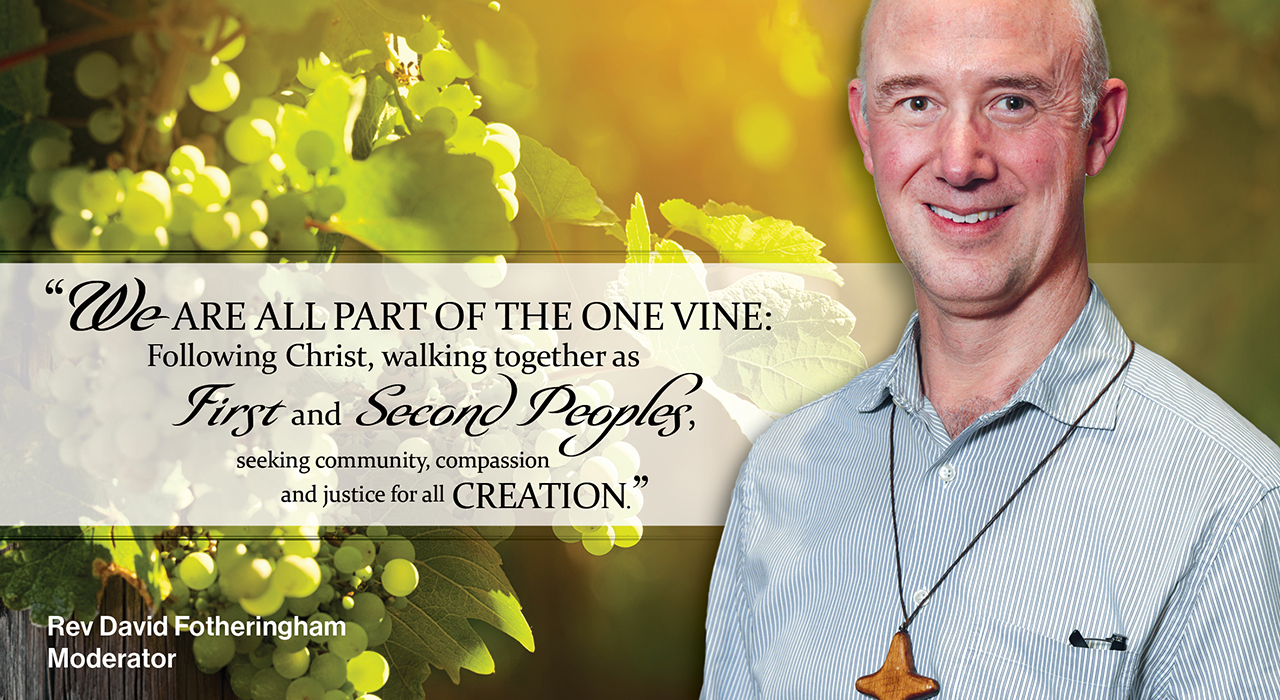

Mel’s mission statement

Hope and the hub

Blessed are the poor in spirit

By Bill Loader |

Christianity’s big questions

By Geoff Thompson |

Lent and the purpose of mission

By Nigel Hanscamp |

Exploring the Old Testament

An introductory online unit for anyone who wants to know more about the Old Testament. Exploring the Old Testament was also written and developed to encourage faith and discipleship formation. Exploring the Old Testament has been created around Worship and Preaching Competencies for Biblical studies from the ‘Assembly Standards and Competencies for the Formation and Education for…

Science and Faith Converse

If you are looking for ways to engage people across the age spectrum in the big questions of Science and Faith, then this event is for you! It will include hands on opportunities to explore the big questions of the environment, science, faith… and more! Dates: 10th May 7:30-9:30 pm & Saturday 11th May 9…

Soul Care 2024

Soul Care 2024 12-13 September Wesley Conference Centre, Sydney & Online Rediscover and reimagine pastoral care at SoulCare 2024 You’ll be energised, inspired and equipped to bring transformative pastoral care to your church, community and school. Discover innovative developments and practices, understand community-based approaches and explore existing ministries and programs that give you opportunities…